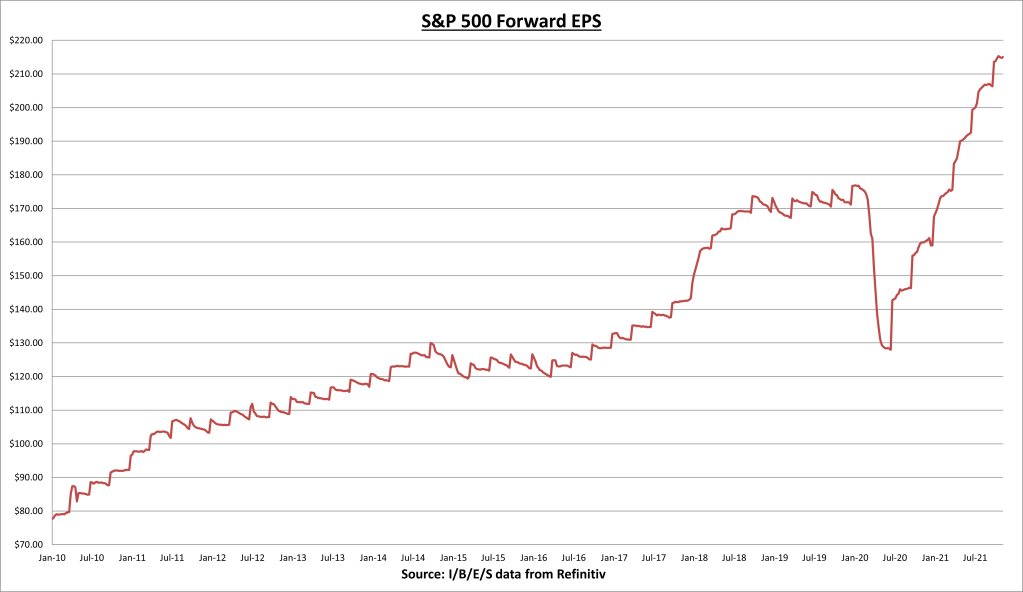

S&P 500 earnings update

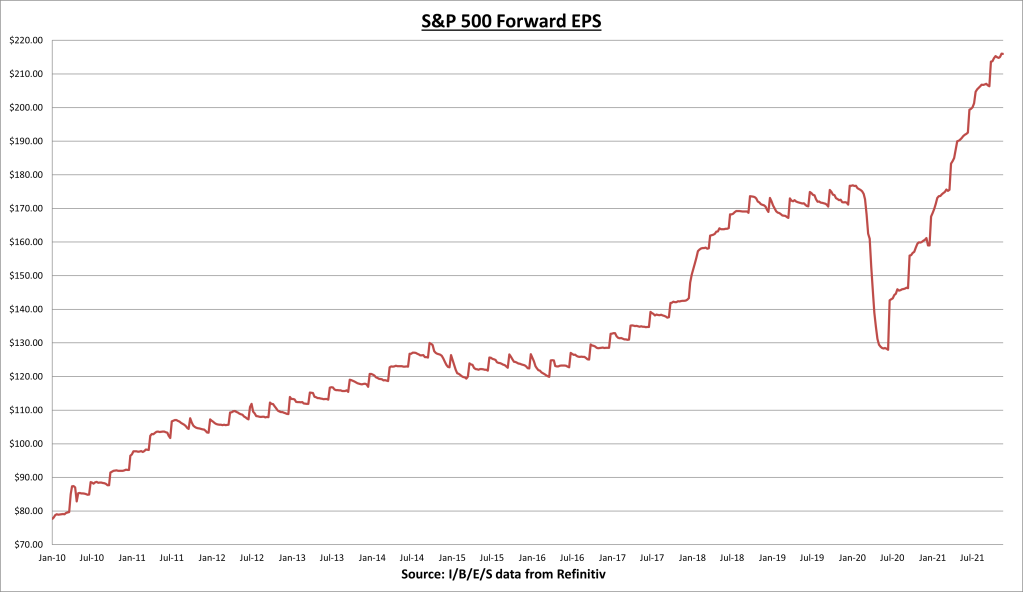

S&P 500 earnings per share (EPS) increased to $216.90 this week. The forward EPS is now +36.4% year to date. I expect another sizeable increase in the forward EPS as we roll into a new quarter/year.

S&P 500 price to earnings (PE) ratio fell to 21.3, as earnings grew to another record while the S&P 500 declined -1.94% for the week.

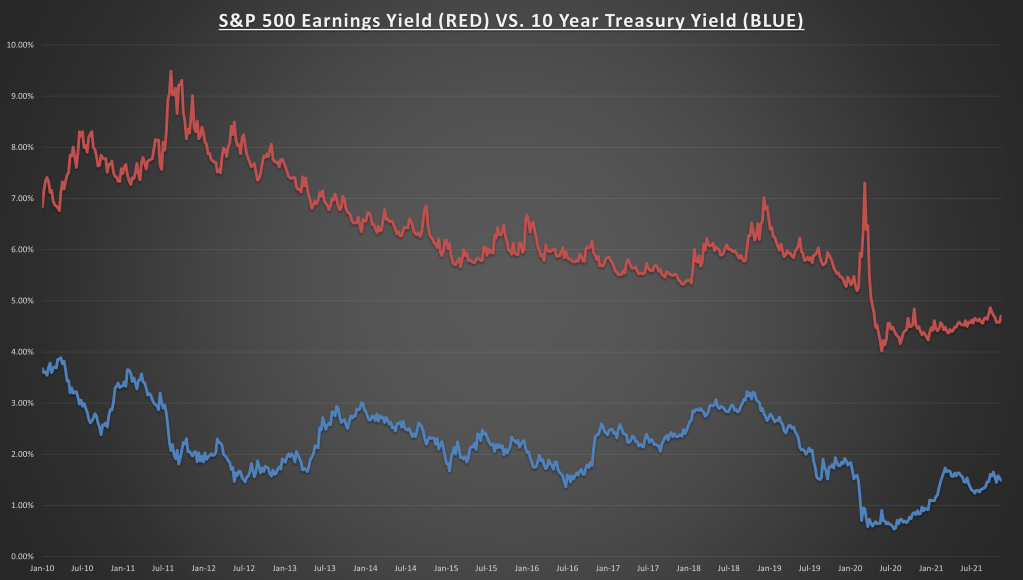

S&P 500 earnings yield is now 4.69%, compared to the current 10 year treasury bond rate of 1.40%.

Economic data review

Producer Price Index (PPI) increased +0.8% in November, which was worse than expectations. Total PPI is now +9.7% higher over the last 12 months, versus the +8.8% annualized rate as of last month. Services prices increased +0.7% for the month, while goods prices rose +1.2%. Higher costs for producers are generally passed onto consumers.

NFIB small business optimism index showed a modest uptick for the month, from 98.2 to 98.4, but it remains a challenging environment.

“As the end of the year nears, the outlook for business conditions is not encouraging to small business owners as lawmakers propose additional mandates and tax increases. Owners are also pessimistic as many continue managing challenges like rampant inflation and supply chain disruptions that are impacting their businesses right now.”

The % of small business owners expecting better business conditions over the next 6 months declined to tie a 48 year low, and % of owners raising selling prices increased to the highest reading since 1979.

In total, 4 of the 10 index components improved for the month, while 4 declined and 2 were unchanged.

“The economy still has plenty of fuel to keep growing well into 2022. Economic policies in 2022, however, will become even more uncertain as it is an election year and the issues are diverse and high energy politically; tax increases, regulations, spending, climate, social goals, and government appointments, to name a few. Specifically of concern for small business owners is the current Build Back Better legislation which includes a significant tax increase for many. With a 50/50 Congress, anything can happen! And then there is Covid, which will continue to put its thumb on the scale of economic outcomes.”

Total retail sales for November came in below expectations at $639.8 billion (another record high), but still grew 0.3% for the month and +18.2% over the last 12 months. The monthly gain was led by gasoline (+1.7%), food & beverage stores (+1.3%), and food services & drinking places (+1.0%). It appears consumers made their holiday purchases early to avoid any shortages, which pulled forward some of the sales data into last month. If not for inflation (which increased 0.8% for the month) the November retail sales data could very well have been negative.

Retail sales data only covers the money spent on goods. We should continue to expect a gradual rotation in consumer behavior, shifting more purchases to services. Nothing wrong with that.

Industrial production for November increased +0.5% for the month, and +5.3% over the last 12 months. This was the highest industrial production reading since September 2019. Capacity utilization increased to 76.8 but remains below the long term average of 79.6.

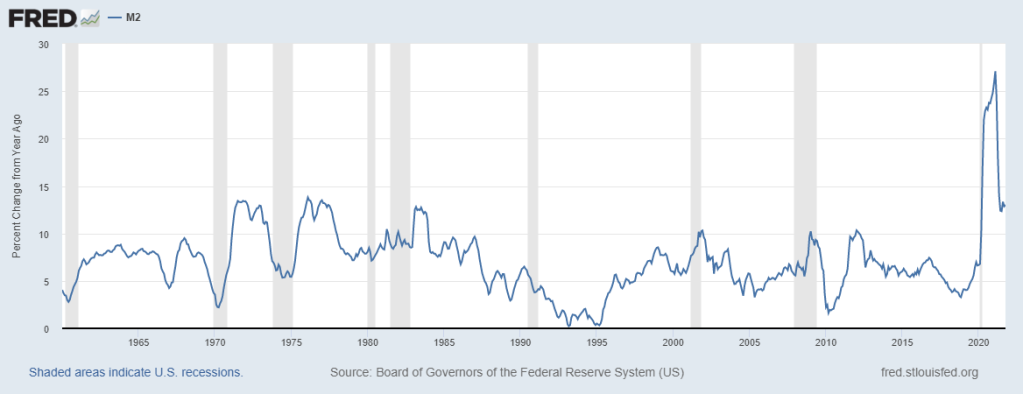

Federal Open Market Committee (FOMC) gave its policy statement and economic projections. They announced a reduction to their monthly bond buying program by an additional $30 billion ($20B treasuries, $10B MBS), which means the program will now end in March as opposed to June. The Fed fell behind the curve by refusing to accept inflation wasn’t going to be transitory, and now they are pivoting to clean up the mess they helped create.

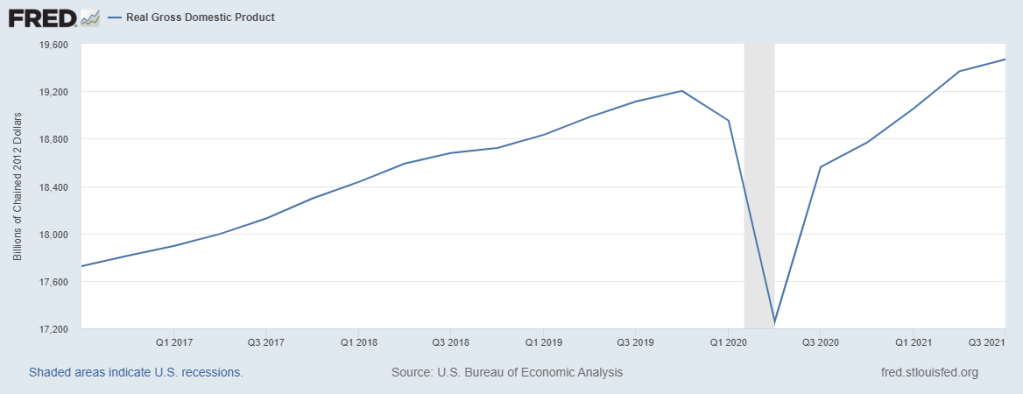

The above chart is the latest economic projections compared to where they were in September. The Fed now believes 2021 GDP will come in lower (5.5% compared to 5.9%), while 2022 GDP will come in a bit higher (4.0% compared to 3.8%). They expect PCE inflation for 2022 will come in at 2.7%, (compared to 2.3% estimate in September) which shouldn’t be taken seriously because they were so far off in 2021.

The majority of voting Fed members now expect three 25 basis point rate hikes for 2022, a sharp contrast from just a few months ago when the majority of voting Fed members projected zero rate hikes in 2022. Do you remember not too long ago when the Fed projected zero rate increases throughout 2023?

Notable earnings

Adobe (ADBE) reported quarterly adjusted EPS of $3.20, which was in line with expectations and 14% growth. Quarterly sales came in at $4.11 billion, which was 1% above estimates and 20% growth. The forward guidance for Q1 came in below expectations on both sales and earnings. The street was expecting EPS of around $3.39 but the guidance came in at $3.35, and sales expectations were approximately $4.33 billion while the company guided for $4.23 billion.

Not awful, but when you have a stock trading 20x sales and 40x forward earnings, any miss on forward guidance is likely to produce a negative short term reaction. In this case, reported results basically came in line with expectations and forward guidance was a miss. Not much for bulls to get excited about in the short term, but it doesn’t change the long term fundamental picture for one of the better run companies in the world.

Summary: The data continues to support the economic expansion, earnings are great and valuation remains reasonable. But it was all about the Fed this week. The Fed’s sharp pivot could have a negative effect on financial conditions in 2022. Financial conditions aren’t the ultimate driver of asset prices over the long term, but they can have a short term/temporary effect on markets. After the FOMC statement and projections, the yield curve (spread between short term and long term interest rates) continued to compress, from 80 to 75 basis points. The Fed mentioned that it could reduce its balance sheet (essentially sell its long term treasury holdings) to push up long term interest rates and give them more room to increase short term rates to fight inflation. This is interesting, the last time we had CPI running this high, the 10 year treasury bond rate was north of 10%!!!

Essentially this is a good thing. The sooner we can get back to a normalized monetary environment, the better. But we are in uncharted waters. Anyone who tells you they know exactly how this will play out is lying to you.

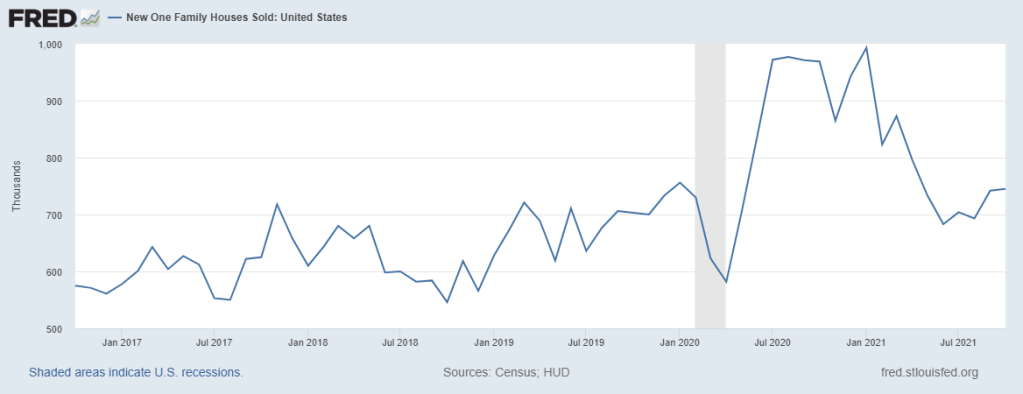

Next week: 6 S&P 500 companies will report quarterly earnings. For economic data we have the CB leading economic index (LEI) on Monday, the final reading on Q3 GDP, consumer confidence, & existing home sales on Wednesday, Core PCE, personal income and new home sales on Thursday.