In the last post we discussed the divergence between the different market caps for US equities. The hypothesis was that this divergence between large cap strength and mid/small cap weakness, coupled with seasonality trends, could spark a short term sell off in domestic equities. So far the thesis is playing out as US stocks are being dragged down by the rest of the world. So now let’s look at the divergence in global equity markets.

The above chart is the Stoxx 600 index, which is generally regarded as Europe’s equivalent to the S&P 500. Euro stocks did drop into bear market territory earlier this year, dropping 27.12% off its 52 week high. As of yesterday’s close the index is down 17.81% from its 52 week high. But resistance abounds just up ahead and it will be interesting to see if the upside momentum can gain enough steam to reverse this downtrend.

The downtrend began after peaking out in May of 2015, then proceeding to drop 85 points (roughly 20%) before beginning a retracement rally from late August to December of 2015. Another 85 point drop ensued from the new lower high…

…after bottoming out in February, the retracement rally resumed and has now almost equaled the size of the prior failed retrace rally. We couple this with the technical resistance at 350 and the downsloping 200 day moving average and I would say this resistance area will define whether the downtrend will be broken, or is about to resume towards yet another lower low.

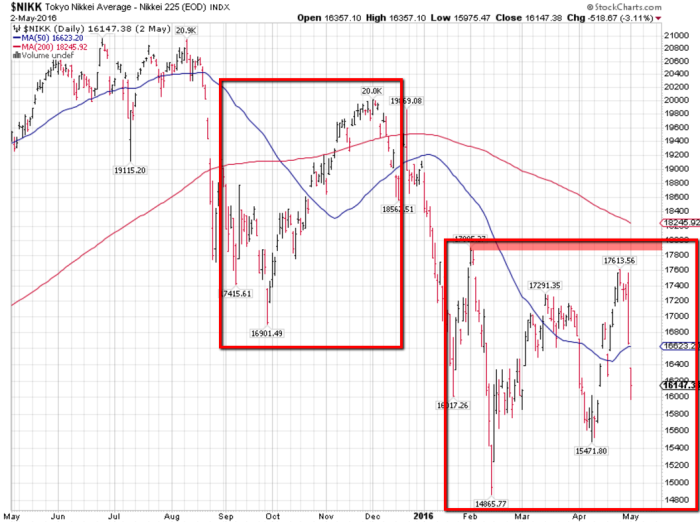

Unfortunately the rest of the world is looking even grimmer. Japan’s stock market index is seen in the chart above. It’s clearly in bear market territory, down 29.21% from it’s 52 week high and currently down -23.11%.

Just like Europe, Japan’s retrace rally has just about matched the size of the prior and so a plethora of technical resistance is all waiting up ahead. It’s going to take some significant efforts by the bulls to overcome.

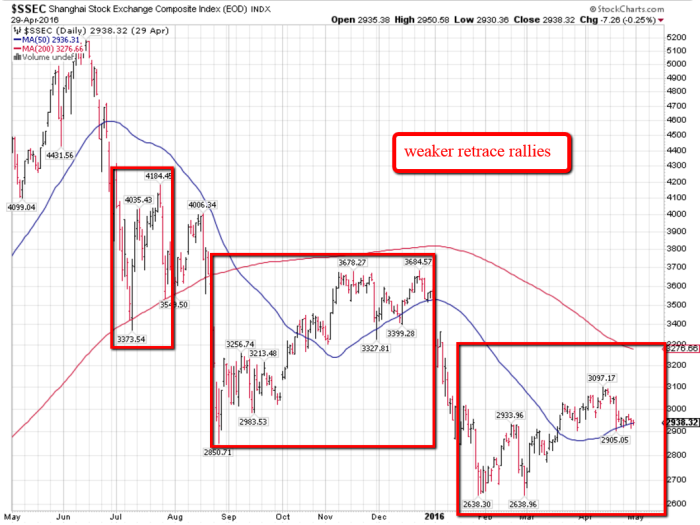

Lastly we have China’s stock market index, that is also currently in bear market territory, and has clearly suffered the most amount of damage. Down 49.05% from it’s 52 week high, and currently down -42%.

Lastly we have China’s stock market index, that is also currently in bear market territory, and has clearly suffered the most amount of damage. Down 49.05% from it’s 52 week high, and currently down -42%.

The retrace rallies appear to be getting weaker. This could be a sign of consolidation, building a foundation for the next bull market, or it could be a precursor to another lower low.

So as the US stock markets are only a few % points off of all time highs, we have Japan and China clearly in bear market territory, and Europe coming out of bear market territory but continuing to look very weak. It’s clearly a pivotal time for global equity markets.

The dilemma is we just don’t quite know how this divergence will affect US equities. There is a case to be made that if the rest of the world’s markets roll over, it has to have a significant impact on US market performance. But you could also make the case that significant deterioration could actually benefit US markets, as global inflows come in to where it’s perceived to be the “lesser of all evils”.

My personal opinion is that if we can continue to avoid an economic recession (which seems likely in the near term) and corporate profit growth returns this year (it’s projected to return in the 2nd half) I believe we should be ok. However there are never any certainties in investing, so having a plan that has stress tested future volatility, and one you’re comfortable maintaining, is always priority number one.

Want to learn how to trade and analyze the markets? Whether you’re a day/swing trader or investor wanting to learn how to analyze trends in the financial markets, there is something in The Trading Playbook for everyone.