“The range of possibilities is still extremely wide on the economic side. I don’t really know of any parallels of the most productive country in the world sidelining its economy and workforce.” – Warren Buffett

The oracle sums up the current predicament well. The future is always uncertain even during normal times, never mind the uncharted waters we navigate today. A mandated government shutdown seemed unfathomable not long ago. Now April data has come in showing the full magnitude of the self-inflicted wound.

This is far from your typical recession. Ordinarily you begin to see “cracks” in the data over time that clue you into the elevated risk. Much like a game of Jenga, where players take one piece out of the tower at a time, slowly weakening the structure until it eventually collapses. In this case, the economy instantly went from being in good standing to being shut down. It’s as if one ran right through the Jenga tower like a linebacker. This goes to show there’s no substitute for good risk management.

What’s become clear is the possibility of a “V-shaped recovery” seems unlikely.

“…what I would exclude right now, I would say, very low probability, the V-shaped recovery.” – Whirlpool (WHR) CEO Marc Bitzer

“In China, the market continues to experience a reduced level of demand as consumers have not fully returned to their pre-COVID routines” – McDonalds (MCD) CFO Kevin Ozan

“The range of possibilities has narrowed now vs. when this started. It is not as bad as it could have been nor is it as good as it could have been.” – Warren Buffett

Fundamental Analysis:

A quick review of the abysmal data:

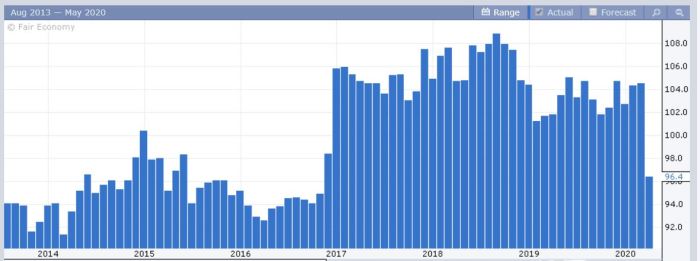

The NFIB Small Business optimism declined from 104.5 to 96.4. One of the biggest single month declines on record and falls back to levels prior to Trump’s election.

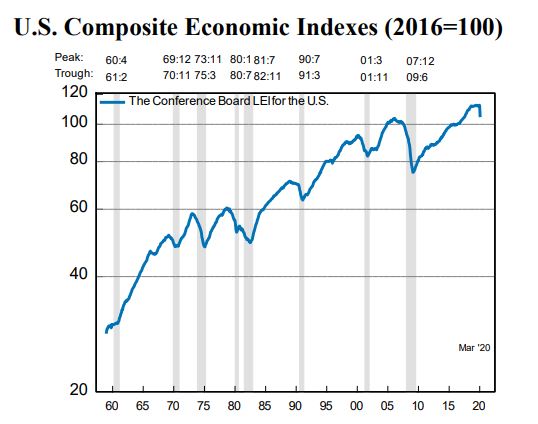

The Conference board’s leading economic index declined 6.7%, marking the largest monthly decline in the Index’s 60-year history.

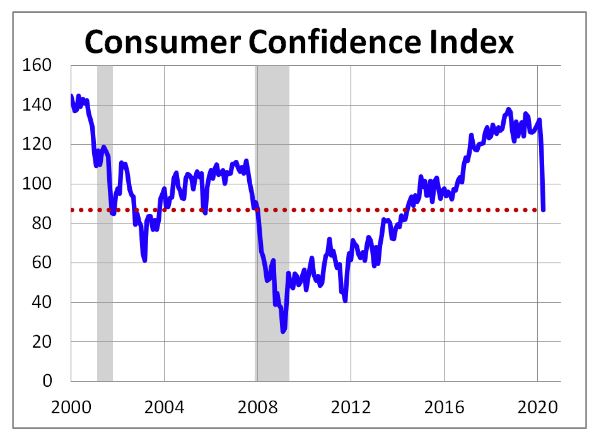

Consumer Confidence declined significantly. Also showing the largest single period decline since the records began.

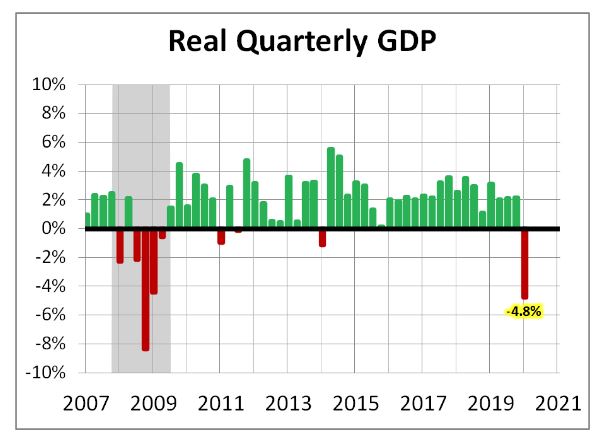

Q1 GDP disappointed, coming in at -4.8%. The gains of January and February weren’t enough to offset the dismal March. Q2 is set to come in at the worst levels in post WWII history, anywhere between -20% to -50%.

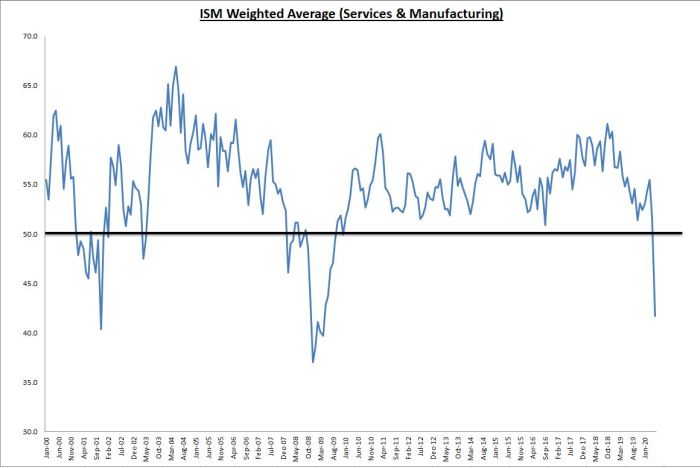

ISM Services came in at 41.8, while ISM Manufacturing came in at 41.5. The cumulative total is approximately 41.7, well in contraction territory.

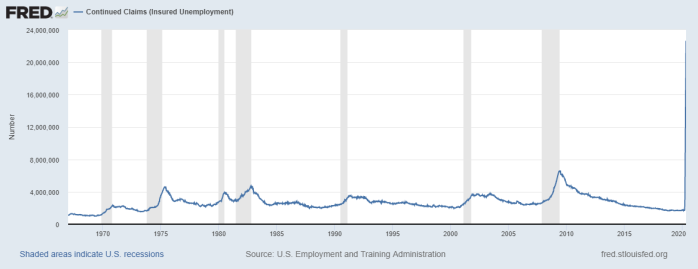

The unemployment rate spiked to 14.7%, above the 10.2% peak of the 2008 financial crisis.

And continuing unemployment claims are “through the roof”. It almost doesn’t seem real.

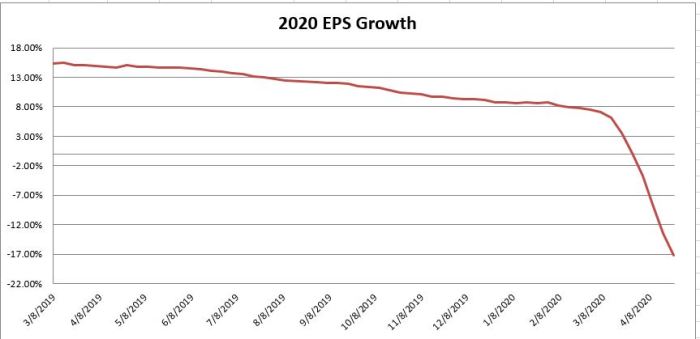

Earnings growth projections for 2020 have cratered from +15% to -20%.

The stock market has gone up as earnings projections have declined. The result is a Price to Earnings (PE) valuation above 20 for the first time since April 2002.

As you can see, the bad news is abundant. The good news is the market is always looking forward. It’s not about what is being reported, its about what may be reported 6 months from now, and how those results compare to expectations. While there is much work to be done, there are reasons for optimism.

“China sales are heading in the right direction.” – Apple CEO Tim Cook

Tickets to Walt Disney’s Shanghai theme park sold out within minutes.

Uber observed ride sharing growth over the last 3 weeks.

Starbucks reopening 90% of its stores by June.

“We are already seeing green shoots suggesting that economies and industries around the world are either rebooting or preparing to reboot in the coming weeks.” – Stanley Black and Decker (SWK) President & CEO James M. Loree

Labcorp says that they will be able to do 200k antibody tests per day by mid-May.

“We also launched serology testing, which helps to determine if an individual has had an immune response to the virus. Currently we can perform more than 50,000 serology tests per day and we expect to perform more than 200,000 tests per day by mid-May” – Laboratory Corporation of America (LH) CEO Adam Schechter

“We believe we are currently in the stabilization phase in most markets,” Ajay S. Banga, Mastercard’s chief executive

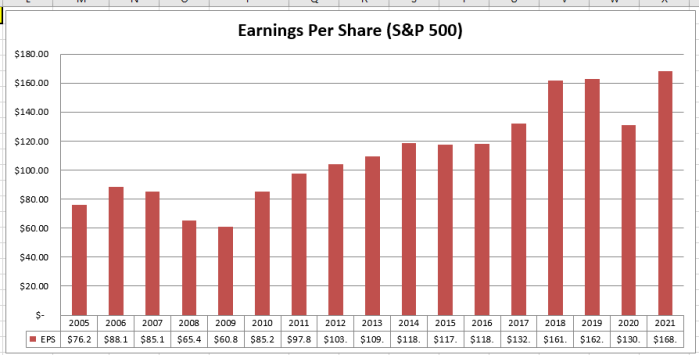

During the 2008 recession, earnings peaked in 2006 and didn’t fully recover until 5 years later. Today, earnings look set to recover by 2021. You see, its not about the magnitude of the recession, its about the length of time. A short, sharp recession still beats a moderate but prolonged one. Take a look at a discounted cash flow analysis example to understand this concept.

Next we look at valuation against fixed income alternatives. With the 10 year treasury rates near all time lows at 0.68%, stocks still look quite attractive from an income and future potential returns standpoint.

The dividend yield on the S&P 500 stands around 2.00%, almost 3X the income level on treasury bonds (even though risk profiles are much different on stocks compared to bonds). The current forward earnings yield is 4.76%, again quite attractive compared to treasuries. This wasn’t the case in 2008.

Technical Analysis:

The Dow and the S&P 500 have both established themselves back above the 200-week moving average. And the Nasdaq has actually turned positive year to date.

The open price gaps above on the S&P 500 at 3,023.94 & 3,130.12 make the next logical target/resistance levels.

I would like to see the AD line firm up more than it has. So far its not confirming strength.

Conclusion:

This is not your typical recession. In this case it’s a good thing. Although the data is abysmal, there is an endpoint. Whereas in the great depression and 2008 there wasn’t such assurances. The recession, although steep, is likely to be shorter than your typical recession. Earnings will likely recover in 1-2 years’ time and with interest rates at historic lows, even if we had another sell-off, the market is unlikely to stay down for long.

No one knows if the March 23 lows was indeed the end of the bear market. The bad news is probably here to stay for awhile and as long as the economy remains closed the risk of more market angst is always present. But we should be optimistic. The public-private health care initiatives have paved the way for new vaccines and treatments to arrive faster than usual. The data on the ground shows the situation is getting better and probably wasn’t nearly as bad as first feared.

Investors who stay the course should be rewarded in due time. But stay well diversified.